DOGE Price Prediction: Technical Support Meets Bullish Momentum

#DOGE

- Technical Support Holding: DOGE maintains above critical $0.1365 support despite trading below its 20-day moving average, creating a potential base for upward movement.

- Contradictory Signals: Negative MACD momentum conflicts with bullish chart patterns and substantial reported buying activity, creating uncertainty about near-term direction.

- Catalyst-Driven Potential: ETF speculation and large accumulation (480M DOGE purchase) provide fundamental catalysts that could override technical weakness if confirmed.

DOGE Price Prediction

Technical Analysis: DOGE Shows Mixed Signals Near Key Support

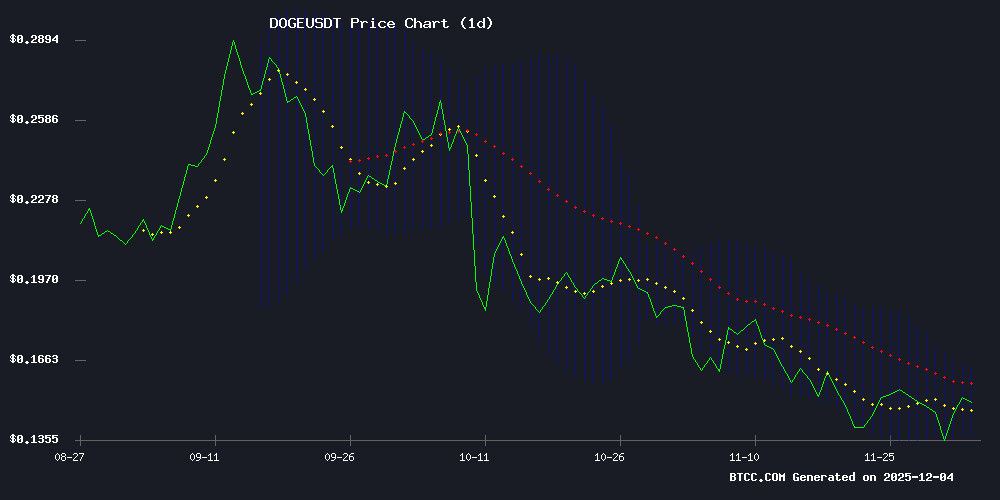

According to BTCC financial analyst Olivia, DOGE's current price of $0.14788 sits below its 20-day moving average of $0.15011, indicating short-term bearish pressure. The MACD histogram reading of -0.003008 shows negative momentum, though the signal line at 0.008581 remains positive. The Bollinger Bands reveal Doge is trading closer to the middle band than the lower support at $0.136533, suggesting the $0.14 level is providing meaningful buying interest. Olivia notes that while technical indicators show mixed signals, holding above the $0.1365 support could set the stage for a rebound toward the upper band at $0.1637.

Market Sentiment: Bullish Catalysts Counter Technical Weakness

BTCC financial analyst Olivia observes that recent headlines paint a constructive picture for DOGE despite technical weakness. The reported 480 million DOGE purchase suggests institutional or whale accumulation, while the 'falling wedge pattern' mentioned in news reports typically precedes bullish breakouts. ETF speculation adds another potential catalyst, though Olivia cautions that such developments often face regulatory hurdles. The $0.57 price target circulating in media appears optimistic relative to current levels but reflects growing retail enthusiasm. Olivia emphasizes that while sentiment has improved, traders should monitor whether news-driven Optimism translates into sustained buying pressure above the $0.15 resistance.

Factors Influencing DOGE's Price

Dogecoin (DOGE) Surge: 480M Buy Sparks Powerful Bullish Momentum

Dogecoin millionaires have accumulated 480 million DOGE over two days, signaling strong confidence in the meme coin's potential. The acquisition, worth approximately $71.8 million, represents 5.69% of the daily trading volume—a significant enough move to influence market direction.

Despite resistance at $0.1534 and prevailing market fear, these large holders are betting on DOGE's upside. Their spot accumulation—rather than leveraged speculation—suggests a long-term bullish stance. On-chain data reveals wallets holding 1M to 100M DOGE drove this demand surge.

The market remains volatile, but institutional-grade buying at current levels could establish a new support floor. Dogecoin's $1.26B daily trading volume shows liquidity depth, though retail participation lags behind whale activity.

Dogecoin Gains Traction Amid Market Volatility, Could $0.57 Be Next?

Dogecoin (DOGE) surged 9.37% in 24 hours, defying broader market turbulence. The memecoin now trades at $0.1499 with a $1.79 billion daily volume—a 44.1% spike—as its market cap climbs to $24.21 billion. Traders eye $0.152 as the next resistance; a breakout could propel DOGE toward $0.21.

Technical charts reveal a rebound from $0.132 support, with a critical test at the descending trendline that’s constrained price action since November. Analyst @trader1sz notes: 'Clearing $0.152 confirms bullish momentum, targeting $0.173 and beyond.' Failure to hold gains may revisit support zones.

Dogecoin Holds Key $0.14 Support Amid Falling Wedge Pattern and ETF Speculation

Dogecoin's $0.14 support level has emerged as a critical battleground, with historical data showing its resilience during market stress. Technical analysts note the potential for a short-term rebound if buyers sustain momentum, relying on traditional indicators like support-resistance behavior rather than social media hype.

While community chatter fantasizes about $1 targets by 2026, data-driven models paint a more conservative picture. Cycle analysis and liquidity trends suggest a near-term fair-value range of $0.18–$0.24, contingent on broader market conditions.

The long-term chart reveals an ascending trendline dating back to 2014, punctuated by breakouts in 2017 and 2021. Though cycle theory has limitations, it provides context for Dogecoin's volatile journey—where memes, ETFs, and institutional curiosity collide.

Is DOGE a good investment?

Based on current technical and fundamental factors, DOGE presents a high-risk, high-potential opportunity according to BTCC financial analyst Olivia. The cryptocurrency shows conflicting signals: technical indicators suggest short-term weakness, while news flow indicates growing bullish momentum.

Key considerations for investors include:

| Factor | Assessment | Implication |

|---|---|---|

| Current Price vs. MA | $0.14788 (below 20-day MA of $0.15011) | Short-term bearish pressure |

| MACD Signal | Negative histogram (-0.003008) | Momentum weakening |

| Bollinger Band Position | Near middle band, above lower support | $0.1365 support holding |

| Large Purchase (480M DOGE) | Significant accumulation | Institutional/whale interest |

| ETF Speculation | Growing but unconfirmed | Potential future catalyst |

| Chart Pattern | Falling wedge (typically bullish) | Technical setup for breakout |

Olivia suggests that DOGE could be suitable for aggressive investors with high risk tolerance, particularly those who believe in the meme coin's community-driven momentum and potential ETF developments. Conservative investors might wait for a confirmed break above the 20-day MA or clearer regulatory clarity regarding cryptocurrency ETFs. The $0.1365 support level represents a critical threshold—a break below this level would invalidate the current bullish narrative.